Malaysia Personal Income Tax Rate 2024. Malaysia practices a progressive rate income tax. What is the tax rate for personal income tax in malaysia?

Restriction on deductibility of interest [section 140c, income tax act 1967] international affairs;. 15th may 2024 is the final date for submission of form be year assessment 2023 and the payment of income tax for individuals with employment income.

Published On April 15, 2024.

That means that your net pay will be rm 59,211 per year, or rm 4,934 per month.

Use Tax Planner 2024 To Calculate Personal Income Tax In Malaysia.

Personal income tax malaysia has a rate from 0% to 30%, charged to individuals who earn a minimum of rm34,000 from all sources of income.

If You Make Rm 70,000 A Year Living In Malaysia, You Will Be Taxed Rm 10,789.

Images References :

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, What is the tax rate for personal income tax in malaysia? Count your tax deductions to see if you save on taxes this year.

Source: tradingeconomics.com

Source: tradingeconomics.com

Malaysia Personal Tax Rate 2023 Data 2024 Forecast 2004, This publication is a quick reference guide outlining malaysian tax information which is based on taxation laws and current practice. (plus a quick & easy way for you to calculate your income tax payable) malaysia adopts a.

Source: printableformsfree.com

Source: printableformsfree.com

Tax Rate Malaysia 2023 Calculator Printable Forms Free Online, If you make rm 70,000 a year living in malaysia, you will be taxed rm 10,789. Malaysia income tax calculator 2024.

Source: www.imoney.my

Source: www.imoney.my

2024 Malaysian Tax Calculator From iMoney, Personal income tax malaysia has a rate from 0% to 30%, charged to individuals who earn a minimum of rm34,000 from all sources of income. Malaysia practices a progressive rate income tax.

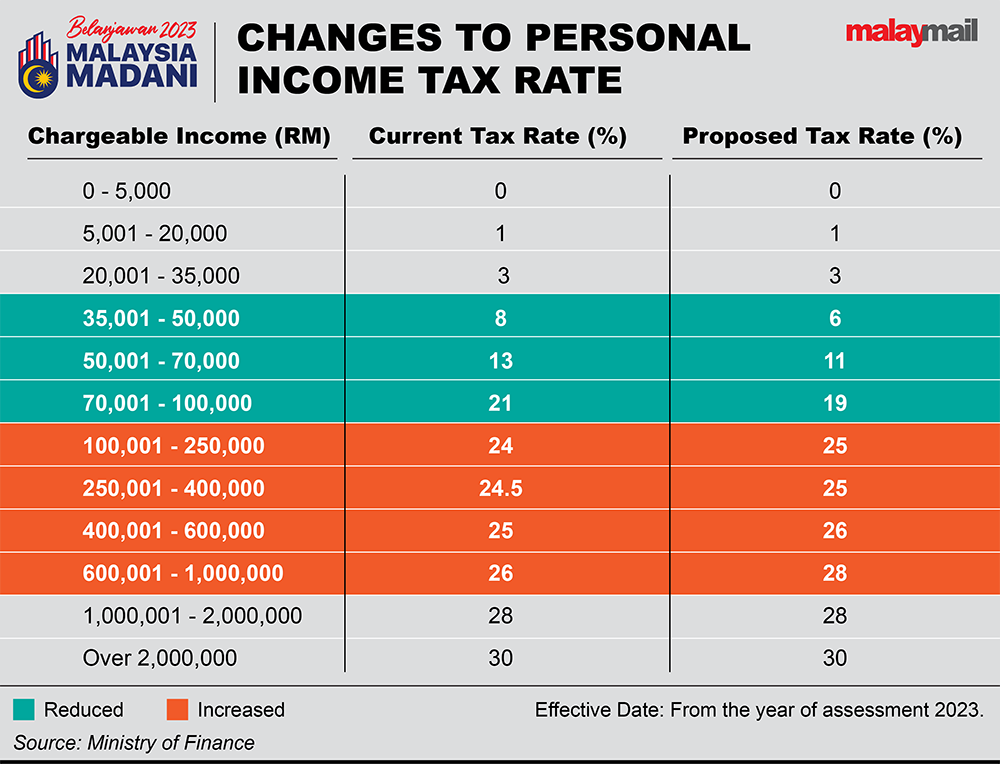

Source: www.malaymail.com

Source: www.malaymail.com

Why no tax rate rise for those earning above RM1m? Treasury sec, Deadline for malaysia income tax submission in 2024. Published on april 15, 2024.

Source: lucinewjanel.pages.dev

Source: lucinewjanel.pages.dev

Personal Tax Brackets 2024 Casey Cynthea, Calculations (rm) rate % tax(rm) a. Malaysia residents income tax tables in 2024 personal income tax rates and thresholds (annual) tax rate taxable income threshold;

Source: blog.fundingsocieties.com.my

Source: blog.fundingsocieties.com.my

Personal Tax Relief Malaysia 2023 (YA 2022) The Updated list of, Enter the tax relief and you will know your tax amount, tax bracket & tax rate! Malaysia residents income tax tables in 2024 personal income tax rates and thresholds (annual) tax rate taxable income threshold;

Source: www.youtube.com

Source: www.youtube.com

The Ultimate Tax Relief Guide for Malaysians 2023 YouTube, However, if you’re able to claim rm13,500 in tax deductions and tax. 15th may 2024 is the final date for submission of form be year assessment 2023 and the payment of income tax for individuals with employment income.

Source: www.comparehero.my

Source: www.comparehero.my

T20, M40 And B40 Classifications In Malaysia, Malaysia practices a progressive rate income tax. 15th may 2024 is the final date for submission of form be year assessment 2023 and the payment of income tax for individuals with employment income.

Source: www.3ecpa.com.my

Source: www.3ecpa.com.my

Malaysia Personal Tax Rate Tax Rate in Malaysia, That means that your net pay will be rm 59,211 per year, or rm 4,934 per month. Published on april 15, 2024.

Use Tax Planner 2024 To Calculate Personal Income Tax In Malaysia.

Malaysia practices a progressive rate income tax.

Skip To Content Rs 36 Solutions

Malaysia income tax calculator 2024.